- Shanghai Zhongshen International Trade Co., Ltd. - Two decades of trade agency expertise.

- Service Hotline: 139 1787 2118

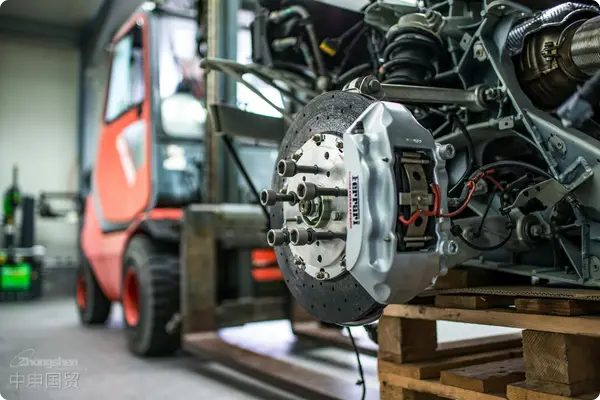

Automotive partsforeign tradeImport RepresentationCost analysis and optimization strategies

——Professional Perspective from a Client Manager with 20 Years of Experience

As a practitioner who has been deeply engaged in the foreign tradeExport RepresentationWith 20 years of industry experience, I am well aware of the complexities involved in the automotive parts import process and the pain points of cost control. This article will systematically outline the core components of import agency fees, influencing factors, and optimization strategies to provide professional reference for enterprises.

I. Core Components of Automotive Parts Import Agency Fees

The import agency fees for automotive parts are not a single cost but rather an accumulation of multiple components, specifically including:

1.Tariffs and value - added tax

- Tariff: Determine the tariff rate based on the China Customs Commodity Code (HS Code) (the tariff rate for auto parts is typically 5%-30%, depending on the type of part, with higher rates for high-value-added products such as engines and transmissions).

- Value - added Tax: A unified tax rate of 13% (calculated based on the CIF value).

Formula: Value-added Tax = (CIF Value + Tariff) × 13%

2.International Transportation Fees

- Maritime Transportation/Air Transportation: A single operation costs about: Charged by volume (cubic meters) or weight (tons), sea freight is cost-effective but has a long cycle (30-60 days), while air freight is fast but expensive (3-7 days).

- Insurance Costs: Generally 0.3%-0.5% of the cargo value (insurance is mandatory under CIF terms).

3.Customs clearance and miscellaneous logistics fees

- Customs declaration fee: Approximately 500-2000 RMB per document (depending on the customs broker's qualifications and operational complexity).

- Inspection and quarantine fee: Some accessories are required3CCertification or commodity inspection, with costs ranging from approximately 1,000 to 5,000 yuan.

- Port miscellaneous fees: Including THC (Terminal Handling Charge), documentation fees, demurrage charges, etc., totaling approximately 2000-8000 RMB.

4.Agent service fee

- The fee is typically charged at 0.8%-1.5% of the cargo value, covering services such as document review, logistics coordination, and risk management.

II. Key Factors Affecting Import Costs

1.The accuracy of commodity classification (HS Code)

- Misclassification may result in hefty fines or return shipments. For example, incorrectly declaring a "transmission assembly" as a "drive component" could increase the tax rate from 10% to 15%.

2.Please translate the following Chinese into English: Selection of trade terms

- FOB and CIF terms directly affect cost allocation:

- FOB: The buyer shall bear the ocean freight and insurance costs, and is responsible for managing the transportation risks.

- CIF: The seller is responsible for transportation and insurance, but the costs may be implicitly included in the price of the goods.

3.Place of Origin and Free Trade Agreements

- Utilizing free trade agreements can reduce or exempt tariffs. For example, importing certain components from ASEAN countries may enjoy a 0% tariff (subject to providing FORM E).It is recommended to verify through the following methods:)

4.Exchange Rates and Payment Methods

- Exchange rate fluctuations between the US dollar and the euro could result in cost differences of tens of thousands of yuan;L/CPayment via (L/C) will incur additional bank charges (approximately 0.1%-0.3%).

III. Practical Strategies for Cost Optimization

1.Accurate Classification and Price Declaration

- Case: A company imported "Automotive Engine ECU Control Modules" and classified them under "Electronic Controllers" (tariff rate 8%) instead of "Engine Components" (tariff rate 15%), saving CNY 24,000 in tariffs for a single batch.

2.Supply chain pre-positioning layout

- Establishing a distribution warehouse in a free trade zone or bonded area allows for deferred payment of tariffs and reduces financial pressure by utilizing "batch customs clearance."

3.Logistics integration for cost reduction

- LCL shipping: For small batch orders, the LCL cost is 30%-50% lower than that of a full container.

- China-Europe Railway Express: 40% cost savings compared to air freight, with a transit time 15 days faster than ocean shipping.

4.The Core Value of Choosing a Professional Agent

- High-quality agency companies can reduce costs and increase efficiency through the following methods:

- Pre-screening documents to avoid customs inspections and port demurrage (daily demurrage fee is approximately 2000 yuan);

- Provide compliant "price declaration solutions" to avoid valuation risks;

- Assist in applying for AEO certification to enjoy priority customs clearance treatment.

IV. Four Major Criteria for Selecting an Import Agency Company

1.Industry Qualifications: Must possess AEO Advanced Certification from customs and international freight forwarding qualification (NVOCC).

2.Data capabilities: Real-time tracking systems (such as ERP integration with customs data) ensure transparent operations.

3.Risk control experience: Familiar with automotive parts technical standards (such as EU e-mark certification, US DOT certification).

4.Service cases: Priority should be given to agents with a background of cooperation with OEMs or Tier 1 suppliers.

V. Conclusion

The control of import costs for automotive parts requires a dual approach focusing on both "compliance" and "strategic" dimensions. Enterprises should leverage professional agency resources, optimize trade policies and logistics solutions, and achieve cost reduction and efficiency improvement while ensuring compliance. For further customized solutions, please feel free to contact the author's team (contact information attached).

Authors Introduction

20 years in foreign tradeimport and exportActing Senior Consultant, with cumulative handling ofImport Customs DeclarationOver 100,000 votes.

Related Recommendations

? 2025. All Rights Reserved. Shanghai ICP No. 2023007705-2  PSB Record: Shanghai No.31011502009912

PSB Record: Shanghai No.31011502009912