- Shanghai Zhongshen International Trade Co., Ltd. - Two decades of trade agency expertise.

- Service Hotline: 139 1787 2118

Introduction

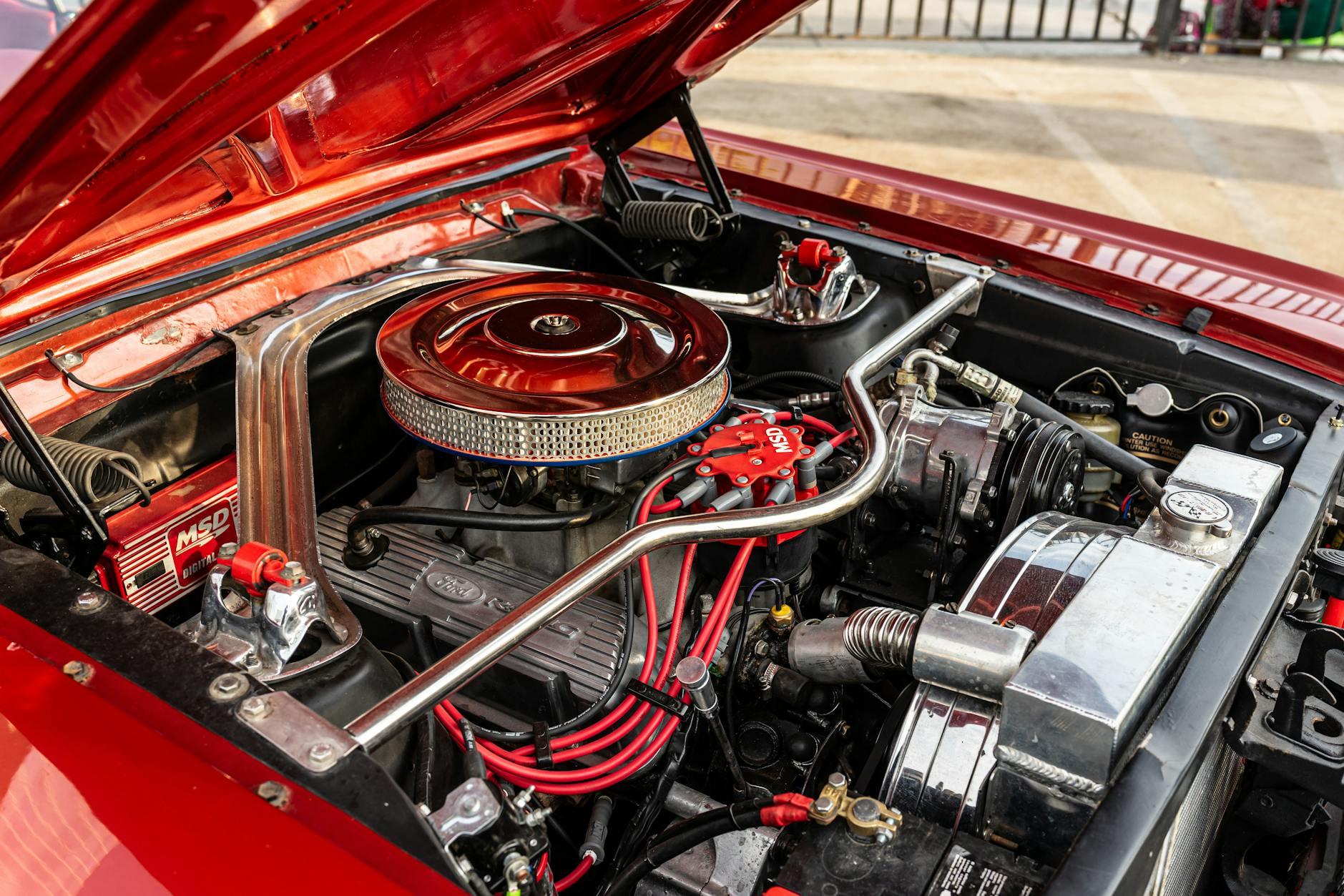

Against the backdrop of a highly - specialized global automotive industry chain, car hoods (front car covers) as important body panels, the import demand is rising year by year. However, the customs declaration process involving complex links such as material classification, origin certification, and safety compliance often becomes a bottleneck in the enterprises supply chain efficiency. Based on 20 years of practical experience in agency services, this article deeply analyzes the core points of car hood imports.

I. Industry Trends and Policy Background of Car Hood Imports

1.Characteristics of Market Demand

- Material Diversification: Aluminum alloy (lightweight trend), carbon fiber (high - end models), and galvanized steel (anti - corrosion demand) have a significantly increasing proportion. The material directly affects the HS code classification and tax rate.

- Centralization of Origin: The demand for accessories of German, Japanese, and American brands is stable. The rise of emerging production bases in Southeast Asia (such as Thailand and Vietnam) brings tariff - preferential opportunities.

2.Policy Wind Vane

- Key Supervision Items of the Chinese Customs:

- Involves3CCertified car hoods (such as intelligent car hoods with pre - installed electronic components);

- Anti - dumping duty risks (such as the EUs tax rate restrictions on Chinese cold - rolled steel accessories);

- Dividends of Free Trade Agreements: Under the RCEP framework, the import tariff of car hoods of ASEAN origin can be reduced to 0% (requires precise planning)It is recommended to verify through the following methods:Clear).

II. Full - process Breakdown of Car Hood Imports (with Time - limit and Cost - control Nodes)

Step 1 Pre - compliance Preparation

- Pre - classification of HS codes(Error rate < 5% is qualified):

Example: Unpainted aluminum alloy car hoods are recommended to be classified under 8708.29, with a tariff of 8%; if there is a paint finish, it is necessary to confirm whether a surface - treatment surcharge is triggered. - Pre - review of documents:

It is mandatory to provide: Certificate of Origin, Material Test Report, Brand Authorization Letter (for OEM parts);

High - risk item: Wooden packaging needs to be labeled with the IPPC mark, otherwise it will face the risk of fumigation and detention at the port.

Step 2 International Transportation and Declaration upon Arrival at the Port

- Selection of Transportation Solutions:

Less-than-container load (LCL) (for cost-sensitive customers) vs Full Container Load (FCL) (preferred for high-value orders);

Special case: Carbon fiber hoods require temperature-controlled containers to avoid moisture damage that may lead to failed quality inspection. - Declaration skills:

The declared value must be strictly consistent with the purchase contract and payment voucher. Under-reporting will trigger customs price inquiries (it is recommended to keep bargaining emails as evidence).

Step 3 On-site inspection and rapid release

- Inspection rate analysis:

The inspection rate of metal hoods is approximately 12% (focusing on the consistency between the alloy composition and the declaration);

Avoidance strategy: Prepare an SGS material test report in advance to shorten the inspection time to within 3 working days. - Label Compliance:

It is necessary to mark: brand, model, material, country of origin (Chinese labels can be affixed later, but need to be noted during declaration).

Step 4 Tax optimization strategy

- Tariff reduction pathways:

Case: A German company achieved a tariff reduction from 10% to 0% by transiting and processing in ASEAN and using the FORM E certificate; - VAT deferral:

Under the bonded warehousing mode in the zone, the 13% VAT can be postponed, relieving the cash flow pressure.

III. High - incidence risk cases and response plans

Case 1: Return shipment due to non-compliant materials

- Problem: A company imported aluminum alloy engine hoods, but customs X-ray inspection showed excessive iron content, classifying them as galvanized steel (a tariff difference of 5%).

- Solutions: Resubmit the component analysis of a third - party testing agency, and release after paying the differential tax (it took 22 days and the additional cost increased by 8%).

Case 2: Intellectual property disputes

- Problem: Hoods imitating the LOGO of a Japanese brand were detained by the customs and faced infringement fines.

- Countermeasure: Establish a brand authorization database, requiring suppliers to provide proof of trademark use authorization chain.

IV. Innovative practices of digital customs declaration

1.Intelligent classification system:

Input material, size, and process parameters, and AI automatically recommends HS codes (with a measured accuracy rate of 92%).

2.Real - time tracking of customs clearance status:

Connect with the customs single - window API to push early warnings for inspection, tax payment, and release nodes.

Conclusion

Engine hood imports are not just a logistics activity but a comprehensive test of supply chain compliance capabilities. Enterprises need to build a management system integrating policy interpretation, process design, and risk contingency. Choosing an agency service provider with specialized qualifications for automotive parts can reduce hidden costs by 15%–20%, maximizing supply chain value.

(Note: The data in this article is based on the public data of the Chinese customs in 2023 and actual enterprise operation cases. Policy changes shall be subject to the latest announcements.)

Authors Introduction: Deeply engaged in theExport Representationindustry for 20 years, serving over 500Automotive partsImport enterprises lead the design of a standardized customs clearance system for automotive parts, achieving a 40% optimization rate in single customs declaration efficiency.

Related Recommendations

? 2025. All Rights Reserved. Shanghai ICP No. 2023007705-2  PSB Record: Shanghai No.31011502009912

PSB Record: Shanghai No.31011502009912