- Shanghai Zhongshen International Trade Co., Ltd. - Two decades of trade agency expertise.

- Service Hotline: 139 1787 2118

Will the duplicate PI numbers cause confusion on the client's end?

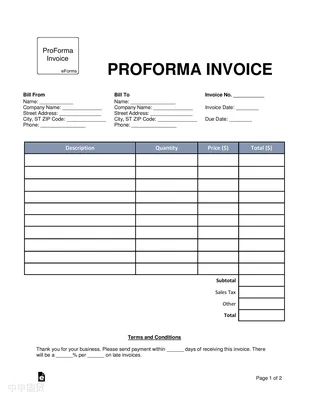

Imagine you're a busy exporter who accidentally assigned the same PI number to two different orders for the same client, such as "ABC003" for both. As a result, when the client made the payment, they noticed the issue and cleverly added "ABC003 XXX" and "ABC003 YYY" in the remarks to distinguish between them. Upon checking the bank statement, you realized the mistake—the first order had already been shipped, so the PI number couldn't be changed. You quickly updated the second order's PI number to "ABC003-YYY." Now, you're a bit concerned: Could this cause any trouble for the client?

Don't be too nervous! Since the client has already differentiated the payments, it shows they are very meticulous and willing to cooperate. As long as their internal accounting can recognize these two payments and match the document numbers during customs clearance and pickup, there usually won't be any major issues. The key is that you must ensure all documents for the second order—such as the commercial invoice and customs declaration—are uniformly labeled as "ABC003-YYY," so the client won't find it confusing when they receive them.

What should be written on the commercial invoice? ABC003 or ABC003-YYY?

The issue is actually quite simple. Since the PI number for the second order has been changed to "ABC003-YYY," the contract field on the commercial invoice must also state "ABC003-YYY." Why? Because in international trade, document consistency is king! From the PI to the invoice and even the bill of lading, if the numbers don't match, customs might raise questions, and the client could be left confused. So, don't hesitate—just write "ABC003-YYY" to keep all documents neat and clear.

Should we inform the client? Will they request a refund and a reprint?

My suggestion is: Take the initiative to inform the client and send the updated PI. After all, the client has already distinguished the orders when making the payment, which shows they are quite cooperative. Sending a new PI not only appears professional but also avoids potential disputes in the future. Draft an email with a brief explanation: "We noticed the duplicate PI number. To avoid confusion, we have updated the second order to ABC003-YYY. Attached is the new PI for your reference." This approach is both polite and hassle-free.

As for refunding and recharging? It's unlikely. Since the customer has already made the payment and the order is in process, refunding and starting over would be troublesome for both parties. As long as your subsequent documents are correct, they probably wouldn't go through such hassle.

Small mistakes don't panic, experience has your back.

Actually, duplicate PI numbers are not uncommon in the export industry. Some peers have encountered similar situations and simply added suffixes like "-001" or "-002" to distinguish them, or even generated a completely new number. As long as the customer and the bank can match the details, and the goods align with the documents, the business won’t be affected. As someone once said, "If the foreign clients have made the distinction, there’s definitely no problem." This time, the customer helped you "cover" the issue—consider it a small lesson!

Conclusion: Details determine success or failure, so pay more attention next time.

Although the duplicate PI number was just a minor oversight, it serves as a reminder: in export business, every single digit on the documents must be scrutinized. From the PI to the commercial invoice, and even during customs clearance, being meticulous never hurts. This time, the client cooperated well, but don't count on luck next time. When preparing a PI, take an extra glance at the number—don't let small oversights become major setbacks!

Related Recommendations

? 2025. All Rights Reserved. Shanghai ICP No. 2023007705-2  PSB Record: Shanghai No.31011502009912

PSB Record: Shanghai No.31011502009912