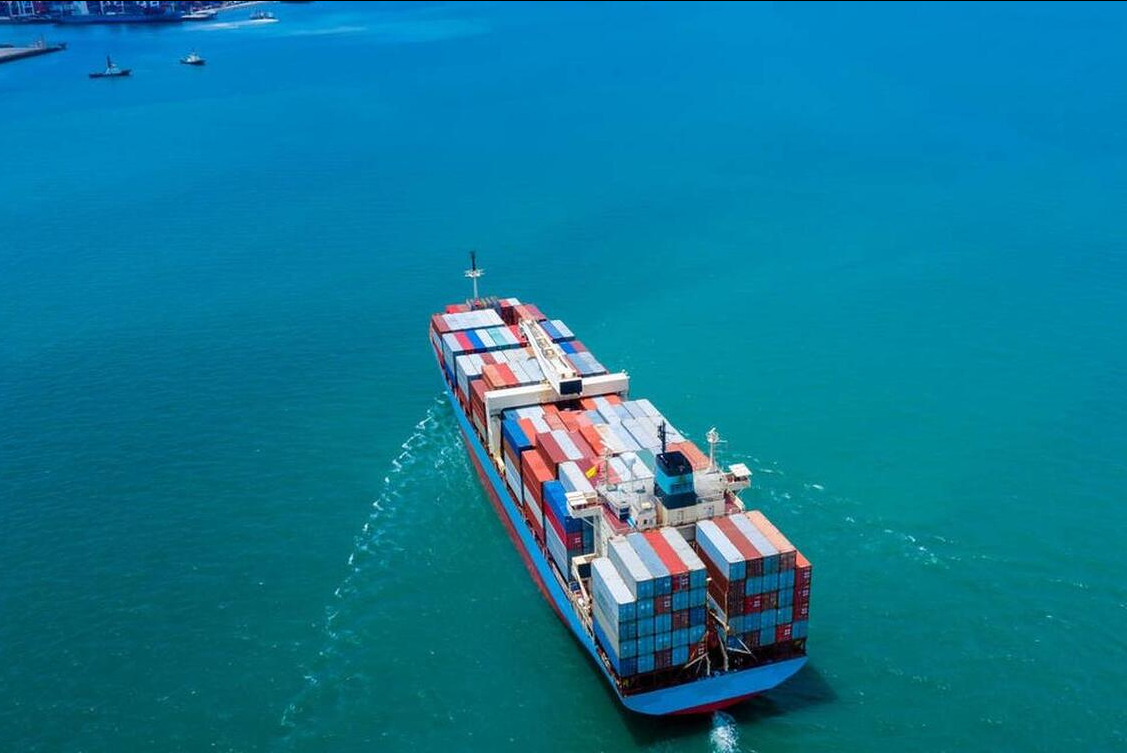

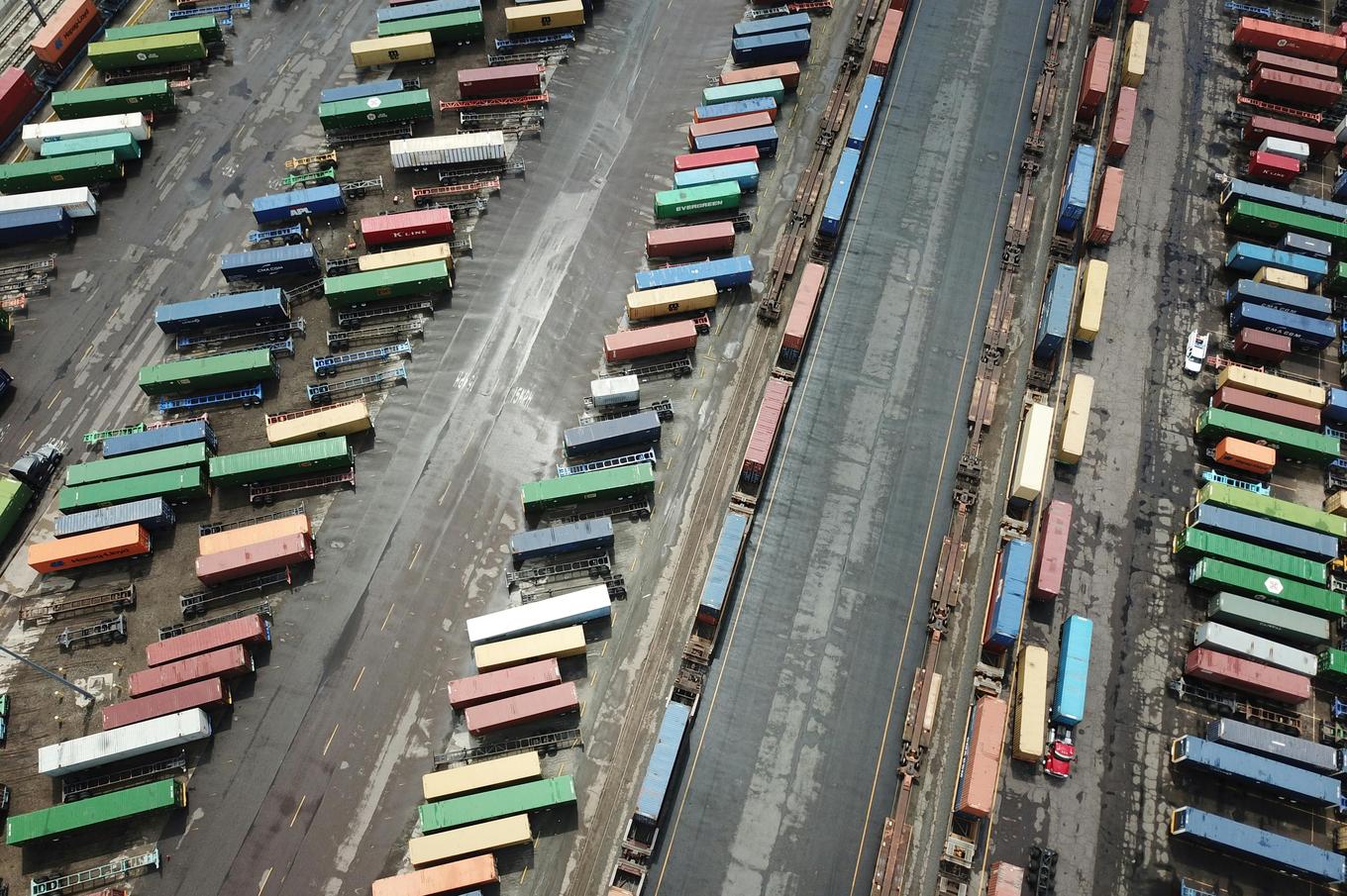

- Goods Transportation : Choose the appropriate transportation method based on the goods. For sea freight, book shipping space, arrange container loading, and handle customs clearance. During customs declaration, accurately declare goods information and truthfully fill out the customs declaration form. For pneumatic components requiring inspection and quarantine, prepare in advance and cooperate with relevant authorities.

1. Necessity of Certification : Imported pneumatic components often require compliance with relevant certification standards, such as the EUs CE certification and the USs UL certification. These certifications serve as entry permits for specific markets, proving that products meet safety and quality standards.

PSB Record: Shanghai No.31011502009912

PSB Record: Shanghai No.31011502009912